An Explainer: What’s driving the cost of fertilizer?

Update: Soaring Natural Gas Costs Slow European Nitrogen Fertilizer Production Again and Push Up Costs

Nutrien continues to work hard to alleviate the shortfalls in fertilizer production caused by global supply chain disruptions and the Russian invasion of Ukraine earlier this year. However, Nitrogen fertilizer production is under pressure again as rising natural gas costs in the EU force several manufacturers to curtail or halt production. While these events have a knock on effect, Nutrien continues to operate at the highest levels of output compatible with safety at its facilities across North America, continues its previously announced capacity expansion through brownfield projects, and continues to develop a clean ammonia project at its Geismar, LA facility that would create 1.2 million metric tonnes of new production with 90% + CO2 capture subject to a final investment decision in 2023.

Published: Jun 06, 2022

We understand the concerns that farmers have about fertilizer costs. Like all commodities, the cost of fertilizer is determined by broad forces of supply and demand in the complex and continuously evolving global market. There are several factors that have had a negative impact on the production and global trade in fertilizers since the start of the COVID-19 pandemic. Below, we explain what those factors are and what Nutrien is doing to address them.

What key factors are driving fertilizer costs?

1. Unprecedented demand and supply constraints

The COVID-19 pandemic created two big waves – first with an economic plunge in 2020 and then a major comeback spurred by consumer demand later in 2021. The unexpected demand caused supply chain issues throughout the transportation system, which added to disruptions in fertilizer supply. These bottlenecks in the supply chain created a ripple effect that not only put strains on final outputs but contributed to price fluctuations.

2. Geopolitical Influences

The Russian invasion of Ukraine in early 2022 has had an enormous impact. International sanctions on Belarus, one of the world’s largest potash producers, already had a significant impact at the end of 2021. With sanctions on Russia, nearly 40 percent of global potash production is in question. Russia is also the world’s largest nitrogen fertilizer exporter. In addition to this, Chinese domestic policy shifts towards boosting crop production, which supported domestic fertilizer demand growth but tightened export supplies have also impacted what we see today in the urea and phosphate global market.

3. Production and energy costs

Natural gas, an essential element for most nitrogen fertilizers, has spiked in price several times throughout 2021 and 2022. As a result of the high input costs, production has diminished and in some places in Europe, shut down entirely. Nitrogen fertilizer is produced globally, and its costs reflect global input costs as well as the result of less nitrogen fertilizer being produced.

4. Climate change and natural disasters

Extreme temperatures, ice storms and recent natural disasters like Hurricane Ida in the Fall of 2021 not only impact the communities we live and work in, but they also impact fertilizer production facilities. These climate and weather events have impacted energy input costs and interrupted production and slowed deliveries, all of which further contribute to fertilizer costs. Just like there isn’t one factor influencing global fertilizer supply, there isn’t one solution for dealing with the problem.

What Nutrien is doing

While Nutrien alone can’t fill the massive shortfall in supply caused by the Russian invasion of Ukraine, we are doing everything we can to meet demand safely and sustainably. This includes working with growers to ensure they have the products and services they need. Through our Carbon program, 2,000 proprietary products, and full acre planning, we are uniquely positioned to help farmers deliver higher crop yields and maximize productivity. Our 3,900 agronomists work closely across our 500,000 grower accounts to provide digital tools, soil testing and innovative products that ensure efficiency in fertilizer and other crop input applications.

On top of our March announcement that we would increase potash production capacity in 2022 to 15 million metric tonnes (a 20% increase over 2020), on June 9, 2022, Nutrien announced that it would accelerate potash production even further to achieve 18 million metric tonnes production capacity by 2025. By the end of 2022, about 70% of all new global potash production will have been delivered by Nutrien and our 18 million metric tonnes production target will mean a 40% production increase vs. our 2020 production. At our nitrogen fertilizer plants across North America, we have added almost 1 million additional tonnes of capacity from 2018 to 2021. We have started a second phase of projects that are expected to add 500,000 additional tonnes by 2024 to 2025 and will do so with considerably lower CO2 emissions.

See additional resources to learn more

Related stories

Explore more about Nutrien

Sudeepta Mohapatra loves the thrill of the chase

In my role I track the global agricultural fundamentals that help in predicting short to long-term trends driving the future direction of the global agriculture industry. I also develop and update various economic models. These models are used to estimate and predict crop input expenditure in our [...]

Read more

Nutrien Releases 2023 Global Community Impact Report

Nutrien’s Community Relations & Investment (CRI) supports our business purpose by nurturing communities through collaborations with community partners who share our values and help us to make a positive and lasting impact in the communities where we operate. “While we share CRI data and stories [...]

Read more

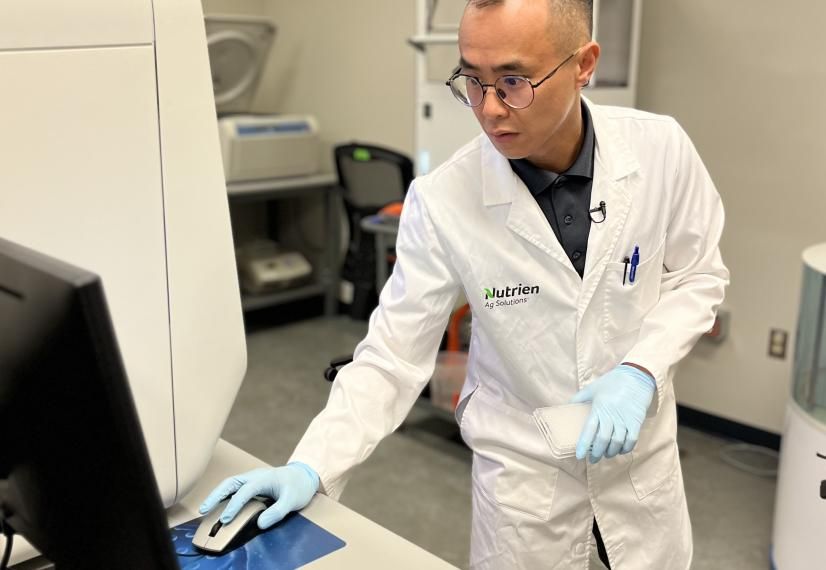

Using DNA analysis to make more resilient crops

Did you know that Nutrien has a Genotyping lab? It’s located in our Canola breeding facility in Saskatoon, Saskatchewan. Employees like Li Tan, Lead, Molecular Biology, work in the lab to analyze DNA for specific genes within plants.

Read more